Chartered Accountant Write for us: Tax matters arise in every business aspect, from day-to-day VAT to share schemes. Tax accountants prepare corporate and personal income tax statements and formulate tax strategies involving financial choice, how best to treat a merger or acquisition, deferral of taxes, when to expense items, etc.

Chartered Accountancy is a professional practice of accounting, auditing, taxation, and financial assessment for an individual or an organization.

Financial Returns

Chartered Accountancy includes filing tax returns, auditing financial statements and business practices, registering the business organization with the government, maintaining records of investments, preparing and reviewing financial reports and documents, etc. A professionally trained Chartered Accountant is also qualified to offer advisory services to clients, including companies and individuals.

The certification of Chartered Accountancy is the prerequisite to professional practice as a CA in India. Becoming a certified Chartered Accountant requires completing three levels of training designed by the Institute of Chartered Accountants of India (ICAI). The ICAI is a statutory body that regulates and maintains the chartered accountancy profession in India. Under the Scheme of Education and Training.

A candidate can pursue a Chartered Accountancy course through a Foundation Course Route or Direct Entry Route. A foundation course is the entry point into the course after Class 12, and the Direct Entry route is for those who have completed Graduation.

What Are the Qualifications Required to Become a Chartered Accountant?

A chartered accountant, commonly called a CA, is one of India’s most prestigious and high-income professions. This might be a great career option if you are interested in business, taxation, auditing, budgeting, accountancy, statistics, and financial management. In this article, we describe the role of a chartered accountant, the different job opportunities in the career, and the qualification requirements to become one.

Chartered Accountant Qualifications

There are three levels in the CA course. You need to complete all three levels to become a certified CA. The eligibility criteria for the different levels are:

Foundation

The first level is the CA foundation course, the standard proficiency test. The course lasts four months, and the minimum eligibility criteria are 10+2 in any stream. You need to clear the CA foundation exam after completing the course.

Intermediate

The second level is the intermediate course, which lasts three years. The eligibility criteria for this course is Graduation with 55% aggregate marks in commerce or 60% aggregate marks in non-commerce subjects or qualifying at the first level. There are two groups of CA intermediate exams, and you need to clear both.

Final

The third level is the CA final course, with two years of duration. You must pass level 2 and complete two and half years of article ship to be eligible for this course. After the course and article ship, you need to clear the CA final exam to become a CA. The Institute of Chartered Accountants of India (ICAI) regulates chartered accountants in India. After completing the three-level course, ICAI conducts CA exams and certifies the candidate as a qualified chartered accountant.

What is the age limit for the Chartered Accountant course?

There is no age limit to qualify for the CA exam. You can register for the foundation course at any age if you have completed your 10+2. You can directly enroll for the intermediate course at any age if you are a commerce graduate with a minimum of 55% aggregate marks or a non-commerce graduate with a minimum of 60% aggregate marks.

Critical Skills for a Chartered Accountant

Critical Skills for a Chartered Accountant

Here are the critical skills needed to succeed as a chartered accountant:

Communication skills

As a chartered accountant, you may interact with multiple people and businesses daily. You need good communication skills to prove your knowledge before the client, build trust, and close the deals. Similarly, strong communication skills are necessary to explain complex financial or tax-related concepts easily.

Market awareness

Being aware of the changes in the market and also the tax code is necessary for CAs to do their job successfully. When updated with the latest tax laws and also regulations, you can better and more accurately service your clients. Furthermore. You can offer your clients better financial and investment advice based on the most recent trends and also developments.

Analytical skills

An analytical mindset helps you to evaluate information and also numbers logically and accurately. Analytical skills will allow you to analyze and also assess critical details and help you give better financial advice to your client. Analytical skills also help you stay ahead of the curve and predict trends.

Attention to detail

Chartered accountants must work extensively with numbers and data and formulate complex calculations while filing tax returns. It would help if you were detail-oriented to spot inaccuracies and also errors. You can learn how to increase your precision and accuracy by focusing better.

How to Submit Your Articles

To Write to Us, you can email us at contact@thewhoblog.com

Why Write for Us on The Who Blog- Chartered Accountants Write for Us?

Search Related Terms to Write for Us

Search Related Terms to Write for Us

- chartered accountant

- monty python chartered accountant

- chartered accountant Australia

- chartered accountant office

- ay in the life of a chartered accountant

- Harold Rosenbaum chartered accountant extreme

- Monty Python’s Life of a Chartered Accountant

- monty python chartered accountant sketch

- south african chartered Accountant interview

- a day in the Life of a chartered accountant

- CPA Canada exam for chartered accountants Indian

- the job of a chartered accountant

- chartered accountant comedy

- chartered accountant dance

- Indian chartered accountant as per Canadian standards

- chartered accountant song

- interview of a chartered accountant

- monty python chartered accountant song

- chartered accountant cake commercial

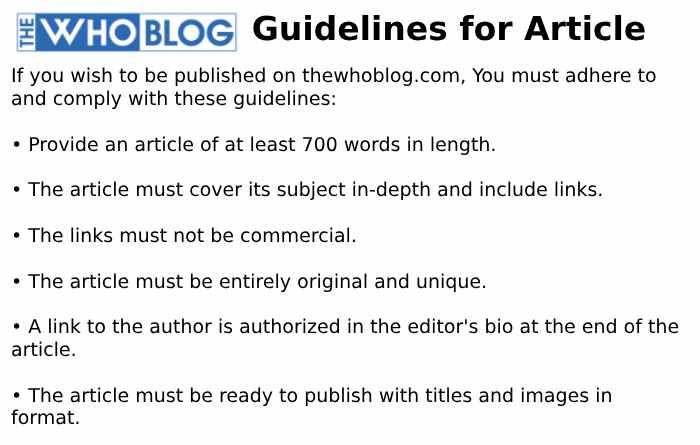

Guidelines of the Article to Chartered Accountant Write for Us

You can send your Mail to contact@thewhoblog.com

You can send your Mail to contact@thewhoblog.com